Amazing group of about 40 people around our half circle, introducing themselves with interests in social justice, human rights, community, the importance of interdependence for resilience with permaculture as a model (Wes Jackson), distribution of power, open source and decentralized software networks, the unraveling of status quo and emergence of something different, the peace economy (the infection of capitalism with empire/control and the concentration of resources dedicated to the military), and more.

Bernard: Unprecedented time in human history. Others thought that, but they were wrong. Convergence of technology, types of crises, particularly in such a short time-span (and in next 5-10 years). Time is moving faster, quickening evolution. We will be forced to change by 2020. We have painted ourselves into a bad corner.

- Aging: more people >65 than ever in human history. Old systems can’t handle that (pensions in Germany started at 65 but most people lived only 48 years).

- Joblessness as reality in current model.

- Climate Change

- 6th extinction & we are the cause

- Monetary system is eratic but the core of power — “the ultimate control device…controls the energy strategies, the food chain, our so-called health-care (a system that keeps people alive until their bank accounts are empty)”

- Political system is stuck in industrial age. Media is a tool of this system. Universities stuck in old model too.

Heyekian economist (“The Road to Serfdom”; see this article contrasting Keynes & Heyek). We don’t fall into either Keynes or Heyek categories. We are orthogonal to these.

Money is an agreement. Once upon a time a martian landed on the wrong side of the railroad track, seeing derelict streets, wilting trees, elders not cared for, kids running wild. He started talking to some humans who said they knew how to fix all of these problems. The Alien asked, “what are you waiting for?” “We’re waiting for money,” they replied. “What is money?”, asked the Alien. The humans replied, “An agreement as a medium of exchange.” The martian left concluding there is no intelligent life on Earth.

“Sometimes to accept is also a gift. The anthropologist David Graeber points out that the explanation that we invented money because barter was too clumsy is false. It wasn’t that I was trying to trade sixty sweaters for the violin you’d made when you didn’t really need all that wooliness. Before money, Graeber wrote, people didn’t barter but gave and received as needs and goods ebbed and flowed. They thereby incurred the indebtedness that bound them together, and reciprocated slowly, incompletely, in the ongoing transaction that is a community. Money was invented as a way to sever the ties by completing the transactions that never needed to be completed in the older system, but existed like a circulatory system in a body. Money makes us separate bodies, and maybe it teaches us that we should be separate.” – Rebecca Solnit, from her book of essays, The Faraway Nearby

Note that when David Graeber is talking about a time before money, he is referring to the vast majority of human existence. Thus, the system he discusses has stood the test of time to a much greater extent than money has. Today, we have notions of “paying it forward” that may represent a continued wish for the continued intimacy of mutual obligation. The essay, “The Tire Iron and Tamale: An act of kindness on the side of the road“, published in the New York Times by Justin Horner, is a good illustration of this.

Stephanie (Dane County Timebank) — Mutual credit: we get together as a network and extend credit to each other. Timebanking a simple form of that: everyone’s time is valued equally. It feels really different to participate in an economy as equals.

Youth Courts: diverting youth from justice system; peers decide what happens (emphasize making connections in community; e.g., sentence someone to drum lessons, she then uses timebank to keep taking them).

Different approaches: (1) Madison Hours = paper currency. These are negotiable: my time is worth X Madison Hours. (2) Price-based mutual credit (WIR system in Switzerland). (3) Community Banking: saving circle that becomes available to members for no-interest loan after saved a certain amount. (4) Cooperative ownership (example of a coop network of 256 companies called Mondragon; BBC article on Mondragon; Allied Community Coop in Madison)

Example: Pay people timebank hours to learn how to do energy consultation & charge people timebank hours for that service.

Community Forge = cluster of people providing web services for free for LETS and timebanks

Bernard — Objectives of Workshop: (1) Next level of Complementary Currency Implementation; (2) Becoming Financially Sustainable in US $ + (problem: Depending only on volunteering = burnout & then collapse.); (3) Develop a long-term resilient governance

(1) Complementary Currency Implementation. Towards a monetary ecosystem (more than one complementary currency in parallel)

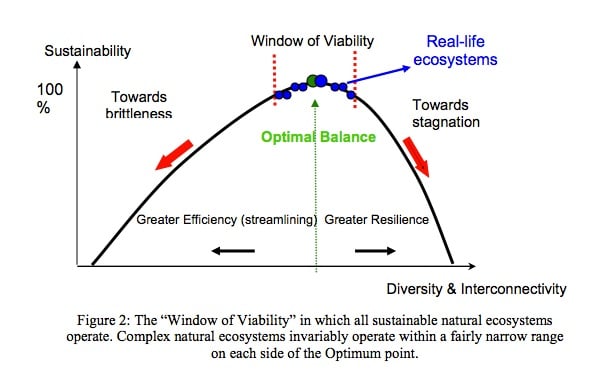

- Complexity Theory and Quantitative Ecology in Maryland. What happens in natural ecosystems? Measures millimeters of biomass going through various ecosystems per year. Sustainability is optimal balance between “efficiency”* and “resilience”**

- * capacity to process volume, quantity of what flows through the system per unit of time, e.g., kilos per year per sq meter; or, $ per year; ** capacity to adapt or change and survive; maintain integrity during change (www.lietaer.com/research).

-

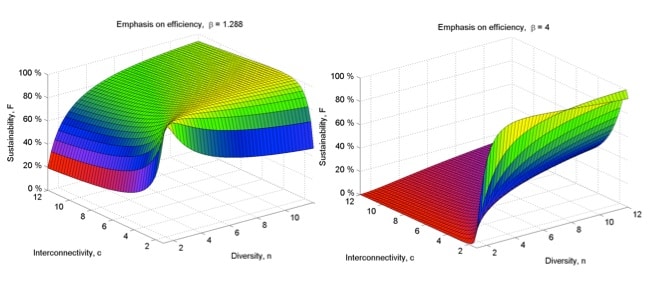

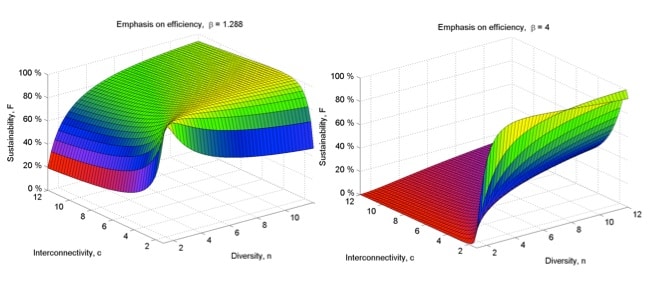

source: http://www.lietaer.com/images/Journal_Future_Studies_final.pdf Source: Lietaer & Dunne (authors of Rethinking Money) – powerpoint slides during Madison, WI workshop, 4/2013 The following figure shows three-dimensional graphs. The left graph shows how large a surface exists for sustainabilty with a balance between efficiency and interconnectivity/diversity/resilience whereas the right shows that if a process gets too tilted to efficiency without enough interconnectivity/diversity/resilience, a sustainable path is almost impossible to find.

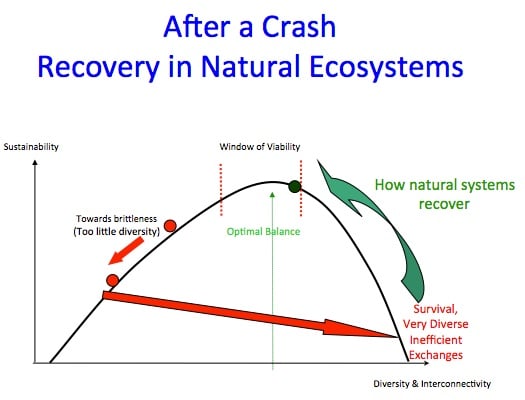

Source: Lietaer & Dunne (authors of Rethinking Money) – powerpoint slides during Madison, WI workshop, 4/2013 - 2 key structural variables (independent of the content flowing through the system so applies to biomass in an ecosystem, electrons in electrical circuit, information in immune system, money in an economy): (1) Diversity; (2) Interconnectivity (e.g., who eats what). High = eats many things vs. eats only one thing. GRAPH sustainability on Y, X = diversity & interconnectivity. Optimal point: on one side, increase efficiency but becomes brittle; on other side, increase resilience but not enough direction to evolve or efficiency. All natural ecosystems fall within 97-100% range of sustainability. Monetary system is to left of optimal (too efficient & too brittle). Results in collapse where we occupy far right of graph (with highly diverse but inefficient systems, like barter, & then powers that be try to return them as soon as possible to previous efficient (one currency) — but brittle — system: happening for 400 years)

- Structural variables can be applied to any ecosystem with same structure

- Resilience is roughly 3 Xs more important than efficiency. Need enough efficiency to make something happen (e.g., growth, evolution). In our financial system we maximize efficiency and it’s actually the only thing we measure.

- Beta is the emphasis on efficiency relative to diversity. In natural ecosystem, lots of space to make mistakes. In current currency system of high efficiency, low diversity, not much space for mistakes. [contact Bernard for 3-D graphs]

- A plan — Phase 1: Legal structure. L3C = low-profit limited liability company: corporation with social purpose; low ceiling on profit (max = 2%). Can operate in all states. Qualifies as investment for Foundations. Could be a restaurant, etc. Can maximize employment as part of social purpose. Considered a good idea to have sweat equity in addition to capital. Phase 2: Viable biz plan which includes a cash cow which requires biz-2-biz service. Phase 3: Identify social purpose systems. Phase 4: Governance. Phase 5: Legal Incorporation (he suggests VT). Phase 6: Software Adaptation. Phase 7: Implementation

(2) Becoming Financially Sustainable. Monetary Ecosystem includes a B2B currency (US $ cash flow)

- MIR approach (MIR = “us”/”economic circle”). Ads: (1) simple, (2) choice of software; Disads: (1) US $ comes from outside the system: (a) income from membership and transaction fees (latter encourages hoarding rather than keep it circulating); (2) No possibility of acceptance in taxes (purposes of taxes is to give value to a currency = creates a systematic demand for that currency).

- PROBLEM of being small: discrepancy in power (small guy needs to pay now or 30 days, but big one will pay you in 90 days). SOLUTION (Brazil): Commercial Credit Circuit (C3). Driven by invoices. Small biz gives big one 90 days but pays 1% for insurance (get a good company to improve faith in C3 units; AAA insurance company = AAA C3 units; first step = get insurance company: start local, then if needed go to insurance company that wants to enter this market) and gets C3 units (alt currency). Try to incentivize circulating = demurrage = parking fee for $. Fee to leave the system. So, total fees = 4-5%. Example: As small biz, I can pay my supplier in $s in 90 days or now for C3 units. They do same with their suppliers. No fees within C3. If your suppliers want US $, they can cash out with the fee. Maybe 20-30% of your money in this & rest in normal currency. Converts illiquid asset into liquid asset. ADS: US $ comes from inside the system, exit fee and demurrage encourage good behavior; possibility for acceptance in taxes. DISADS: more complex, requires participation of insurance company and bank, initially requires use of Cyclos software (open source now)

(3) Develop a long-term resilient governance. Managing currency as a commons. Tragedy of the Commons: Everyone has sheep, buy puts more sheep wins, whole system collapses, but he’s the winner. So, only solution is private ownership. However, there is no evidence this happened anywhere.

Elinor Ostrom “received the 2009 Nobel Prize in Economic Sciences for her groundbreaking research demonstrating that ordinary people are capable of creating rules and institutions that allow for the sustainable and equitable management of shared resources [suggesting a solution to the ‘tragedy of the commons’]. She shared the prize with Oliver Williamson, a University of California economist” (source). Their 7 criteria for managing commons: (1) Clearly defined boundary; (2) Congruence with local conditions; (3) Hyper-democratic: open to bottom-up influence for changing the rules, etc. (most non-profits are not); (4) Monitoring accountable to users; (5) Conflict-resolution mechanisms; (6) Graduated sanctions: users who violate operational rules are assessed graduated sanctions by other users, by officials accountable to those users, or both; (7) Minimal recognition of rights to organize: no contradictions with state or federal laws

“National monetary system should be managed as a commons but it is not.”

Most failures of alt currencies is a governance issues, either burnout of initial leaders or one of Ostrom’s criteria.

3 towns doing what we’re trying to do: (a) Santa Barbara, CA [city government]; (b) Tuscon, AZ [businesses trying to connect to social system]; (c) Madison, WI [social system trying to attach to biz system]

Next steps:

- Prepare proposal (1-3 pages) for 3 cities [3 LC3s but with same format…city level probably too small, country level too big]

- Find an insurance company for C3

- Prepare biz plan for cash cow [can share]

- Agree on governance structure [can share]

- Legal incorporation, probably in VT [one lawyer does for all 3]

- Invite participation of all relevant parties [is this the hard part?]

- Take off…

Discussion with group:

- A game, called polymoney, that uses 2 types of currency (traditional and complementary).

- Jac banks: people save; once save enough, you can get low-interest loans

- Madison timebank: close to being able to have offers and requests in time right now & will also have the possibility of having transactions with $ amount. Could experiment with supply-demand circuits (Troy?)

- Tracking transactions is bridge from current system to one we need. As you know people, you stop logging transactions. Gifting circles can come from timebanking in similar way.

[note] Rob Mclure; WI Grassroots Network; Rachel (The Alchemist); Petra (Village co-housing); Jackie (prisoners); Torproject.org (anonymous internet activity) [/note]

Saw the Slow Money tag and stopped by to check it out. For those who wish to learn more about this movement, get started by signing the Slow Money Principles.

Pingback: Money: Wealth & Inequality | Sustainable Well-being